Convergence

AI-driven customer interaction management.

RetailOps

Integrated order & warehouse management.

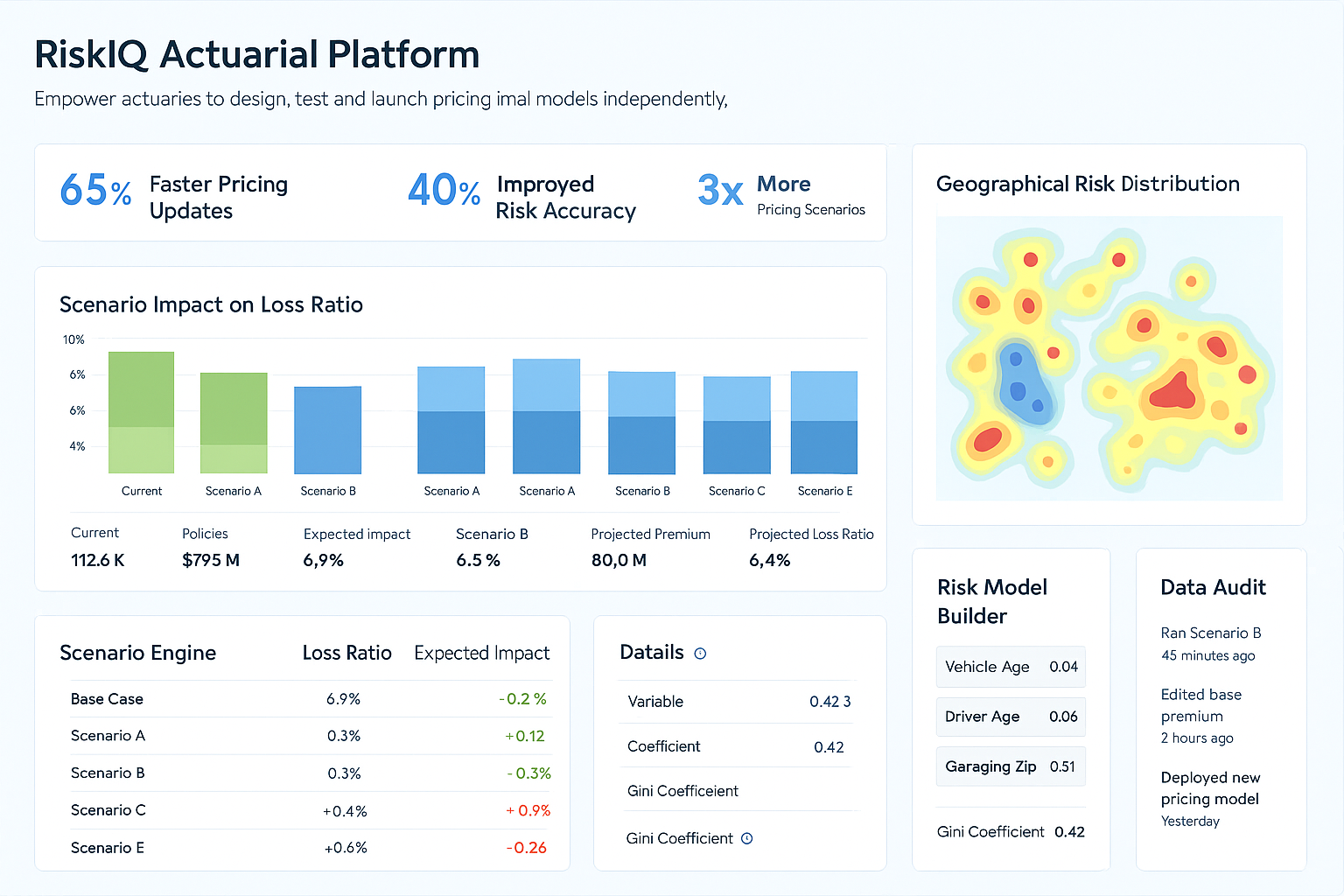

InsureFlow

Digital Front-to-Back Platform for Non-Life Insurance.

Bridge

Integrated order & warehouse management.

ClickBooks

Smart Appointment Scheduling.

AvidCRM

360° real-time customer insights.

DocFlow

Smart Document Management.